Who Hides Assets in a Divorce

When divorcing, the California court wants you to divide everything fairly equally. That is a lot harder to put into practice. Once you loved your spouse and shared debts and assets. Now, you feel hurt and stressed and want the divorce finalized. When a spouse attempts to hide assets in a divorce proceeding, hurt and stress only intensify. Once hiding assets was a maneuver used soley by the super-rich. Today it has spread from high net worth to a broader range of partners. As divorce cases rise and more spouses engage in hiding assets, we felt it was time to revisit the topic.

How Spouses Hide Assets in a Divorce Proceeding

There are past example of spouses transferring money to hidden bank accounts, buying high value items and cashing in insurance policies. They have turned over assets to trusted family members or friends and some even set up bank accounts in the children’s names. Lovers suddenly end up with a new home or car or both. Sometimes the spouse goes abroad on “business” to “park” money in a difficult-to-access institution.

Sometimes jewelry goes missing, horses are suddenly gone and high end cars are “sold” to family members. A spouse might own whole properties never revealed as jointly owned. HFLG has seen it all before, and has a skilled investigative team they use to reveal as many of these assets as possible. The search could be simple, such as the online records of property in their name, or that of one of their companies. On the other hand, investigators and forensic accountants will follow a winding trail, of bank statements with large or frequent transfers of money, accounting discrepancies and financial inaccuracies in both business and personal finances.

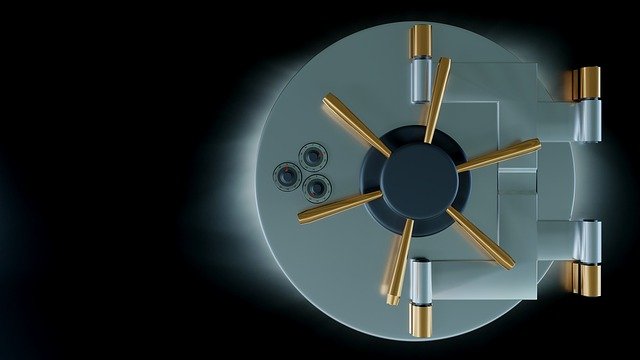

Cash is Easier to Hide

Hiding money is usually easier when the spouse can convert the asset into cash. Inheritance checks could be cashed and placed into a secret safe deposit box without revealing the event to the other spouse. Even the home safe is vulnerable. You both contribute to storing your money there for emergencies. Then one day your spouse is gone and so is $50,000. Since the money wasn’t in a bank account, there is no record that it even existed, making theft impossible to prove. All of this is done in an attempt to reduce the divisible matrimonial assets by a court.

Refunds and Cash Back Are Another Way to Hide Assets

How often does your spouse overpay the IRS bill? Do you ever see the refund check, or is this out of character? Businesses that take in cash regularly, like pizza shops, auto repair shops, convenience stores, home repairs and others make it easy to hide the funds. it might be unreported income or it might just disappear into hidden accounts. A spouse planning ahead might get cash back on regular purchases, all of which goes into a sock drawer or other unlikely off-the-record place. Each of these are ways your spouse can hide assets. In a few days check back for an article on What to Do if Your Spouse is Hiding Assets.

*This article is for informational purposes only. It is not intended to be legal advice. Seek the advice of your family law attorney before you decide on the best actions for your situation. The good news is that you are already on a family law website, and answers are just a click away.